Top China Manufacturer of Diamond Rubber Roller Lagging Solutions

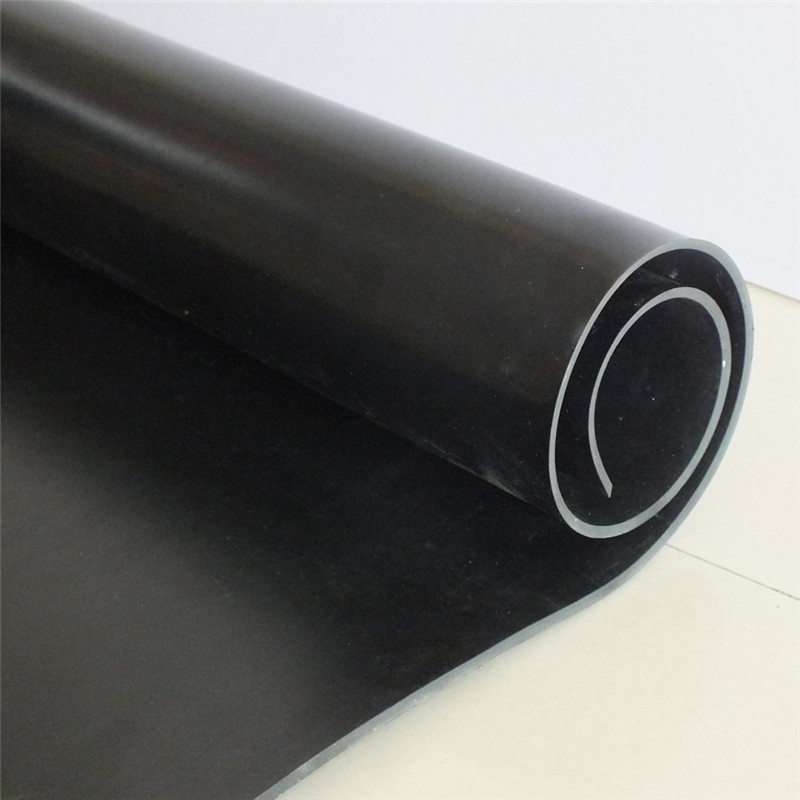

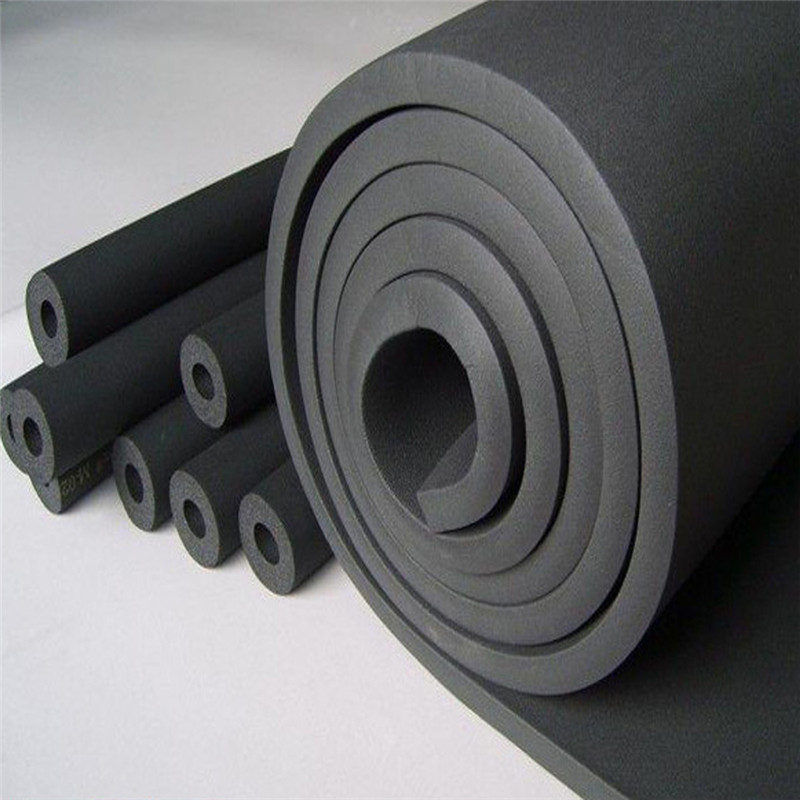

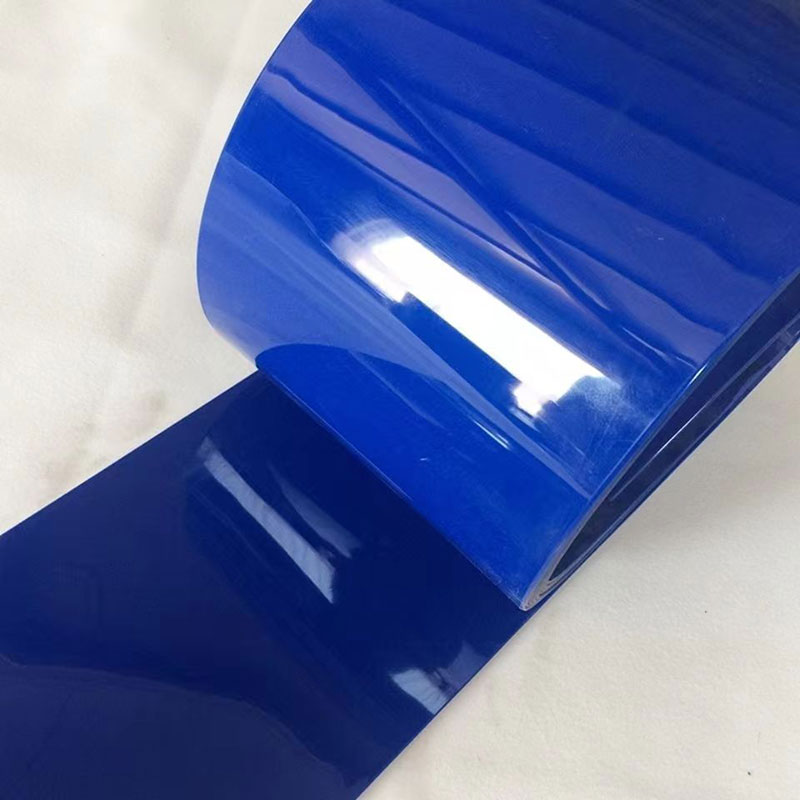

When I sought out the best solutions for enhancing conveyor performance, I found that Diamond Rubber Roller Lagging is a game-changer. Crafted with precision, this product ensures superior grip and extended lifespan for rollers in various industries. Sourced from top-notch manufacturers in China, I was impressed by the quality and durability it offers. I appreciate the seamless installation process, making it a hassle-free option for businesses looking to improve their operations. Whether you're running a manufacturing line or a distribution center, this lagging reduces slippage, increases efficiency, and ultimately boosts productivity. The chinaware expertise in manufacturing guarantees you’re getting an exceptional product tailored to meet your operational needs. With Diamond Rubber Roller Lagging, I can confidently say that it’s a worthwhile investment for anyone aiming to enhance their conveyor systems. Make the smarter choice and trust in reliable performance every day!

Diamond Rubber Roller Lagging Market Leader Where Service Meets Innovation

In the competitive landscape of industrial components, the demand for high-quality rubber roller lagging is on the rise, particularly in sectors where efficiency and durability are paramount. As market leaders, we understand that successful procurement hinges not just on product performance but also on the reliability of service and innovation that accompanies it. Our commitment to excellence in rubber roller lagging solutions ensures that businesses can enhance productivity while minimizing downtime, making us the go-to partner for global buyers seeking superior quality. Innovation is at the heart of our offerings. By continuously investing in advanced materials and manufacturing techniques, we deliver rubber roller lagging products tailored to meet the diverse needs of various industries, including manufacturing, printing, and packaging. Our extensive portfolio represents a perfect balance of resilience and adaptability, ensuring optimal performance in almost any operational environment. We strive to exceed customer expectations, providing not only products but also tailored support that empowers businesses to achieve their specific operational goals. Furthermore, our customer-centric approach ensures that every interaction is met with a high level of attention and professionalism. We understand the complexities faced by global procurement professionals and prioritize swift responses and flexible solutions. By fostering strong partnerships built on trust and reliability, we contribute to our clients’ success stories worldwide. This dedication to service, blended with cutting-edge innovation, defines our leadership in the diamond rubber roller lagging market.

Diamond Rubber Roller Lagging Market Leader Where Service Meets Innovation

| Application | Material Type | Roller Diameter (inches) | Lagging Thickness (mm) | Service Life (Hours) |

|---|---|---|---|---|

| Textile Industry | Natural Rubber | 12 | 12 | 3000 |

| Food Processing | Synthetic Rubber | 14 | 10 | 3500 |

| Printing Industry | EPDM | 16 | 15 | 4500 |

| Conveyor Systems | Neoprene | 18 | 14 | 5000 |

Related Products

Diamond Rubber Roller Lagging Market Leader Ahead of the Curve

Top Selling Products

-

Phone

-

E-mail

-

Whatsapp

-

Top